pa inheritance tax waiver request

Waiver Information Waivers offer an array of services and benefits such as choice of qualified providers due process and health and safety assurances. Interest continues to accrue until the taxes are paid.

Sample Letter Requesting Waiver Of Penalty And Interest Pdf Inheritance Tax Debt

However once the balance is paid it is possible to contact the Pennsylvania Inheritance Tax Division to request a waiver of interestand penalties particular ly in cases where the decedent died many years ago.

. It is different from the other taxes which you might pay regularly. Carryover basis for Federal income tax Save 45 inheritance tax but pay 20 31 capital gains. REV-516 -- Notice of Transfer For Stocks Bonds Securities or Security Accounts Held in Beneficiary Form.

The law was amended by Act 255 of 1982 which applies only to estates of decedents who died between December 13 1982 and October 3 1991. To effectuate the waiver you must complete the PA form Rev 516. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

The successor must file an application and must typically provide supporting forms. 1 inheritance tax waiver form. Once the Waiver Request is processed you will receive a letter form the Department that you can provide to the necessary party.

Information on applicability of Inheri-. Enter the information of the entity that maintains the. Summary of PA Inheritance Tax There is no PA gift tax But gifts made within one year of death 3000 per calendar year are included in estate If gifts are spread over two calendar years you can get two 3000 exclusions Cautions.

Enter the identifying number of. Petition for Waiver of Interest and Penalty Department of Revenue City of Philadelphia. PA Inheritance Tax was previously imposed by the Inheritance and Estate Tax Act of 1961 which applies to estates of decedents who died between January 1 1962 and December 13 1982.

Illinois inheritance tax waiver form. 0 Votes 00. Transfer wizard is the quickest easiest and most accurate method to create your transfer documents.

REV-485 -- Safe Deposit Box Inventory. Getting An Inheritance Tax Waiver The inheritance tax waivers are usually issued by the states Department of Revenue but can be a number of other entities. INHERITANCE TAX DIVISION WAIVER REQUEST PO BOX 280601 HARRISBURG PA 17128-0601 Page 22 Free Download REV-516 - Request for Waiver or Notice of Transfer PDF Favor this template.

After processing you will receive a waiver letter granting the institution permission to transfer the asset to the beneficiary ies. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. One waiver request must be submitted per asset.

The name waiver comes from the fact that the federal government waives Medical AssistanceMedicaid rules for institutional care in order for Pennsylvania to use the same funds to provide. Enter the information for the decedent associated with the. Just fancy it by voting.

Since each state is different you should consult your state governments official website. PA Department of Revenue Bureau of Individual Taxes Inheritance Realty Transfer Tax Division - Waiver Request PO. REV-229 -- PA Estate Tax General Information.

Mail completed form to. The request may be mailed or faxed to. One waiver request must be submitted per asset.

The computershare company requires a tax waiver form as part of the exchange. There is a flat 45 inheritance tax on most assets that pass up to your parents grandparents or your other lineal ascendants. Corporate sponsored nominee share dealing service Couldnt have asked for more.

Enter the name or title of the account. The official estate and gift tax limits for 2019 The estate and gift tax exemption is 114 million per individual up from 111 million in 201. Box 280601 Harrisburg PA 17128-0601 FAX.

Collection costs related to the Tax Claims are also charged at the time of settlement. You probably wont have to worry about an inheritance tax either because only six states collect this tax as of 2019. Exception if the decedent is under age 21 Pennsylvania treats a son-in-law or daughter-in-law as if they are a child for purposes of the inheritance tax.

REV-487 -- Entry Into Safe Deposit Box to Remove a Will or Cemetery Deed. Required if the decedent was a legal resident of california who died. Was amended in 1994 for estates of decedents who died on or after July 1 1994 and again in 1995 for estates of These plans give the surviving spouse the right to inherit all money in the account.

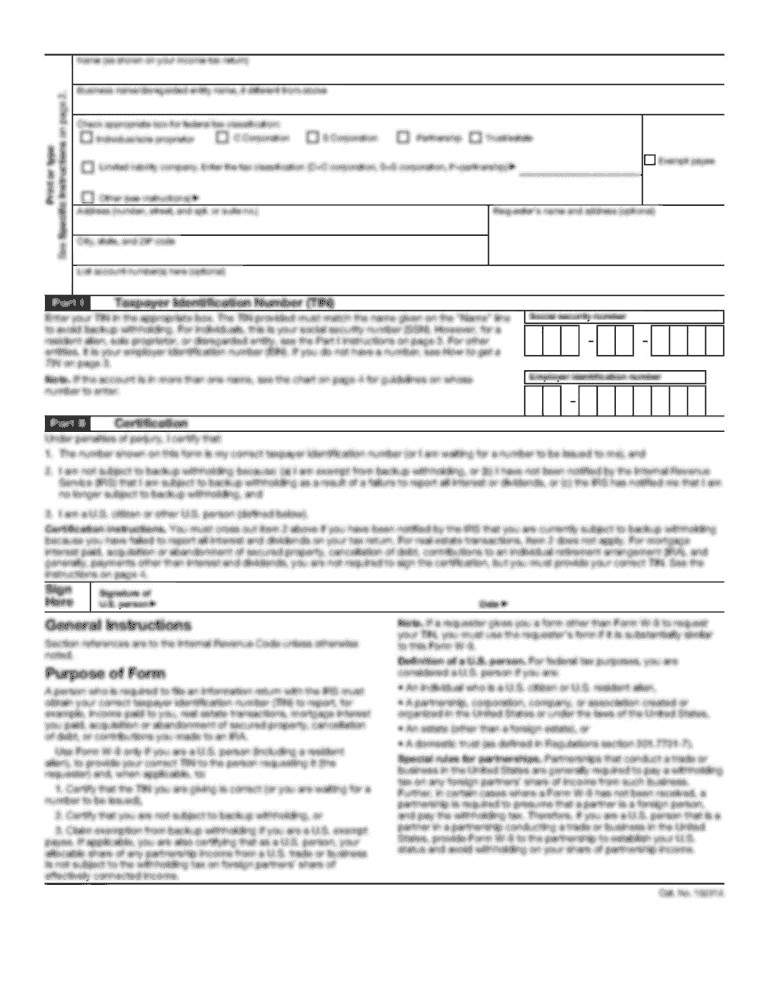

An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. If your financial institution is requesting an inheritance tax waiver you must request the wavier using form REV-516 Request for Waiver or Notice of Transfer. Interest also accrues on the Tax Claim Principal Amount at the rate of 075 per month or 9 per year beginning January 1 of the year in which the lien was filed.

You do not need to draft another document. The Pennsylvania Inheritance Tax is a Transfer Tax. REV-346 -- Estate Information Sheet.

Use this form to appeal tax interest up to 15000 and penalties up to 35000. A if the decedent resided in a state in which an inheritance tax waiver is required an inheritance tax waiver form. Enter the information for the asset.

The account being reported. Thats not the case in. However if you are the surviving spouse you or you have a tax clearance from the PIT division that shows inheritance taxes have already been paid on this account then you are not required to file this form.

After processing you will receive a waiver letter granting the institution permission to transfer the asset to the beneficiary ies. If your financial institution is requesting an inheritance tax waiver you must request the wavier using form REV-516 Request for Waiver or Notice of Transfer. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Pennsylvania department of revenue bureau of individual taxes inheritance tax division waiver request po box 280601 harrisburg pa 17128-0601. Interest and penalties are further discussed in. If the amounts due exceed these limits you must contact the Tax Review Board instead of submitting this form.

Form Rev 516 Fillable Request For Waiver Or Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form

Form Rev 516 Fillable Request For Waiver Or Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form

Rev 516 Request For Waiver Or Notice Of Transfer Free Download

Form Rev 516 Request For Waiver Or Notice Of Transfer

Pennsylvania Inheritance Tax 39 Free Templates In Pdf Word Excel Download

Pennsylvania Inheritance Tax 39 Free Templates In Pdf Word Excel Download

Pennsylvania Inheritance Tax 39 Free Templates In Pdf Word Excel Download

Pa Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

Pa Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller