housing allowance for pastors 2021

This costs the church nothing. 08162021 110400 Title _____.

Housing Allowance Basics Church Law Tax

A housing allowance is simply a portion of a ministers compensation that is so designated in advance by the ministers employing church.

. A pastors housing allowance must be established or designated by the church or. The preferred way to do this is for the church councilboard to. For example in December 2021 a church agrees to pay its pastor total compensation of 45000 for 2022 and designates 15000 of this amount as a housing allowance the remaining 30000 is salary.

While this Regulation does not require the designation. At the end of the year the church treasurer issues Pastor T a W-2 that reports taxable income of 30000 salary less housing allowance. If a minister owns a home the amount excluded from the ministers gross income as a housing allowance is limited to the.

February 16 2021. The IRS lists only food and servants as prohibitions to allowance housing expenses. Taxes without housing allowance.

Money from an IRA cannot count as a housing allowance but money from a church pension or 403b can. You will need this information to fill out Schedule SE and pay your SECA taxes. 1 the amount properly designated in writing as the housing exclusion before payments to clergy begin.

Address the Support section or get in touch with our Support team in case youve got any questions. Your church will report to. Does Housing Allowance apply to retired pastors.

Now youll be able to print save or share the form. Those provisions provide that a minister of the gospel may exclude a housing allowance from hisher gross income. This book is a vital resource for every pastor and financial professional that works with clergy.

A comprehensive guide to the clergy housing allowance covering everything from eligibility and how to claim the allowance to how taking a housing allowance affects the FAFSA or a pastors eligibility for premium tax credits. Salary of 50000 tax rate for 2021 is 12 for Married Filing Jointly and total housing expenses of 28000 rentmortgage insurance taxes utilities furnishings etc. It designated 20000 of this amount as a housing allowance.

The Actual Housing costs must be tracked by the Minister. Salary of 50000 Taxed on 50000 12 6000 Owed income tax of 6000. The IRS allows a housing allowance to retired ministers to the extent the recipient can justify the amount.

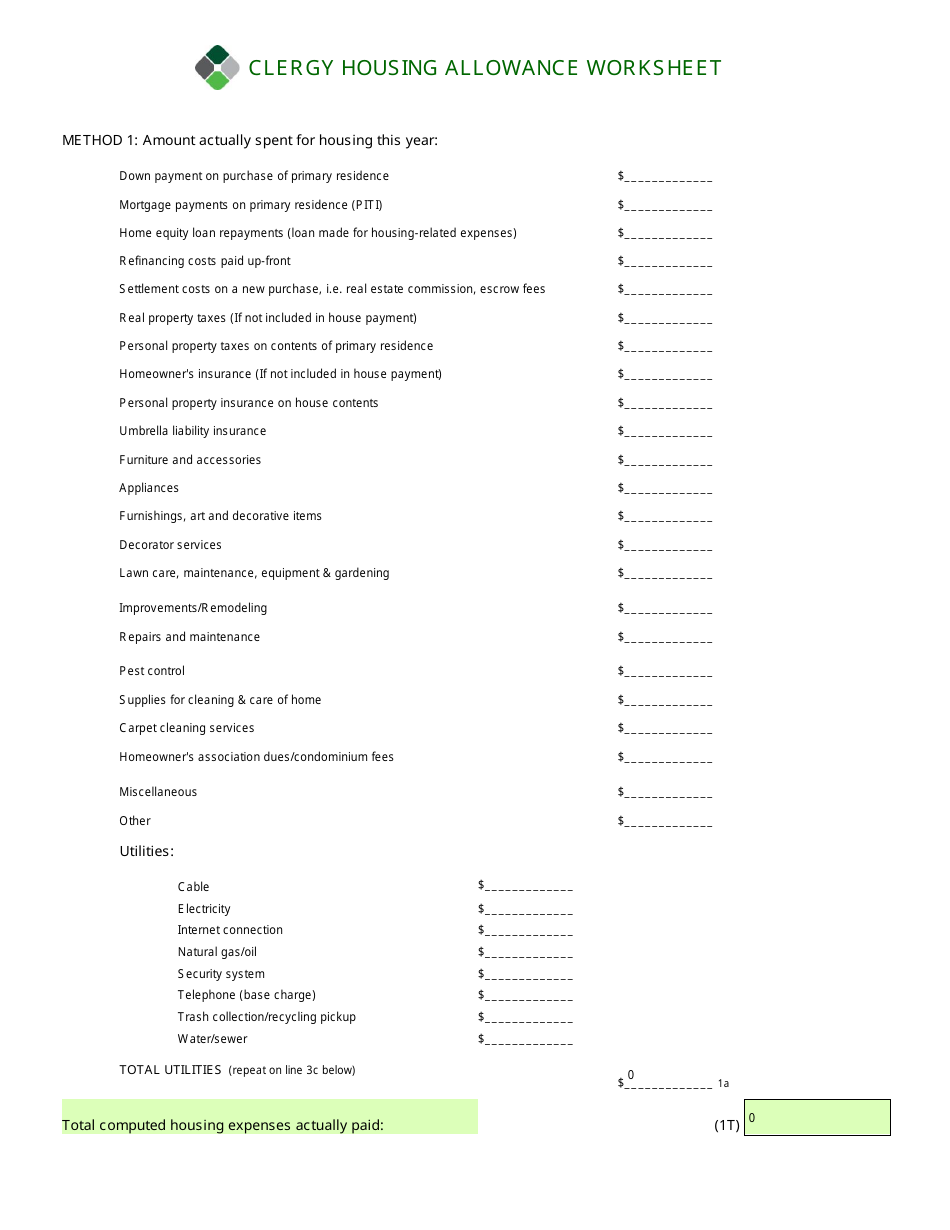

This worksheet is designed to help a clergyperson determine the amount which heshe may exclude from gross income pursuant to the provisions of Section 107 of the Internal. Recorded resolution prior to January 1 of the year it is to take effect which authorizes the housing utility or parsonage allowance in advance of any payment. Generally the housing allowance is reported in Box 14 of the W-2 and is not included in Boxes 1 3 or 5.

The IRS tax code allows ministers to designate part of their compensation as Housing Allowance. July 22 2021. The pastor will need to designate a housing allowance in order for any or all of it to be excluded from the taxable income on the W-2.

IE Beginning June 1 1500 of the compensation to John J Pastor shall be considered as allowance for housing costsor some similar language that makes you comfortable. Box 14 would simply say something like Housing. The fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes.

Churchescharges providing a housing allowance in lieu of a parsonage should follow the Conference. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes. Salary of 50000 tax rate for 2021 is 12 for Married Filing Jointly and total housing expenses of 28000 rentmortgage insurance taxes utilities furnishings etc.

No exclusion applies for self-employment tax purposes. Press Done after you finish the form. The worker may exclude from income.

Retired pastors can claim a housing allowance but only from a church retirement plan. Amy July 22 2021. When understood and implemented fully this can be a lifelong tax advantage for all ministers.

For 2021 the cost for CRSP to the church is 105 of pension plan compensation and. Find Free WordPress Themes and pluginsHousing Manse Parsonage Designation The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization. Utilize the Sign Tool to add and create your electronic signature to signNow the Housing Allowance Worksheet PCA Retirement Benefits Inc Carib form.

Unfortunately theres still a. For less than fulltime pastors housing is a component of compensation to be negotiated between the pastor the church and the District Superintendent. I have a question.

A housing allowance is also available to a minister living in a parsonage to the extent he uses the allowance for his personally paid out-of-pocket costs not paid by the church. Should you receive more than you can justify the excess should be considered taxable. If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and the amount isnt more than.

If it is included on Form W-2 then it has been reported to the IRS. Minister of Religion - Ordained Annual Compensation Scale Page 13. Calculating the Housing Exclusion The amount of income that can be excluded from federal income before federal income tax is calculated but not from federal self-employment income is the smallest of the following three amounts.

That is the way I have asked for it to be done. However Pastor T only has 17000 of housing expenses in 2021. Is an amount paid to a pastor in addition to the salary to cover housing expenses.

As a result taxable income is understated on his W-2 by 3000. Each retired ordained or licensed minister of The United Methodist Church who is or was a missionary of The United Methodist Church serving with the General Board of Global Ministries may designate a portion of up to 100 of the pension payments received from the Collins Pension Plan during the year 2021 as a rentalhousing allowance. You may file a paper return with an attachment stating that you received an exempted housing allowance as a retired clergy member.

2021 42625 907 22 2020 41718 818 20 2019 40900 650 16.

Top 5 Faqs Regarding Minister S Housing Allowance Baptist21

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Kindle Edition By Artiga Amy Religion Spirituality Kindle Ebooks Amazon Com

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance By Amy Artiga

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller Housing Allowance Clergy Allowance

Designating A Housing Allowance For 2021

Get Clergy Housing Allowance Worksheet 2010 2022 Us Legal Forms

Housing Allowance Worksheet Fill Out And Sign Printable Pdf Template Signnow

Pastoral Housing Allowance Fill Online Printable Fillable Blank Pdffiller

Pastoral Housing Allowance For 2021 Pca Rbi

Minister S Housing Allowance Basics Church Accounting Series Youtube

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

Video Q A How Do You Get The Housing Allowance For A Pastor The Pastor S Wallet

From The Son Of A Baptist Preacher How Church Plans And Housing Allowance Work In Your Favor As A Pastor Baptist21

Everything Ministers Clergy Should Know About Their Housing Allowance

Video Q A Changing Your Minister S Housing Allowance The Pastor S Wallet

Four Important Things To Know About Pastor S Housing Allowance Churchstaffing

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance By Amy Artiga

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance By Amy Artiga

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller